All Categories

Featured

Table of Contents

It's vital to remember that SEC laws for accredited investors are made to protect financiers. Without oversight from monetary regulators, the SEC simply can not evaluate the threat and benefit of these investments, so they can't offer info to inform the average financier.

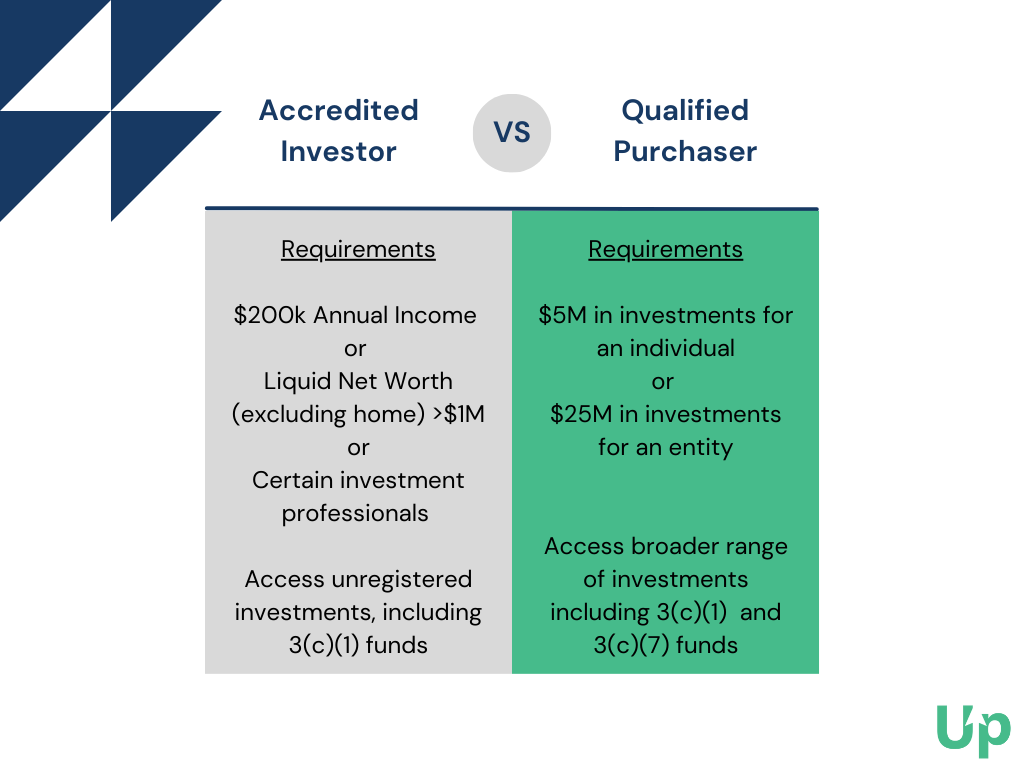

The idea is that financiers that gain enough earnings or have adequate wide range have the ability to take in the threat better than investors with reduced revenue or less wide range. private placements for accredited investors. As a certified capitalist, you are expected to finish your own due diligence before including any kind of possession to your investment portfolio. As long as you meet one of the complying with 4 needs, you certify as a certified capitalist: You have earned $200,000 or even more in gross income as a specific, each year, for the previous 2 years

You and your spouse have had a consolidated gross revenue of $300,000 or even more, each year, for the past two years. And you expect this level of earnings to proceed.

Market-Leading Exclusive Investment Platforms For Accredited Investors

Or all equity owners in the company qualify as certified capitalists. Being an approved capitalist opens up doors to financial investment possibilities that you can not access otherwise. When you're recognized, you have the option to purchase unregulated safeties, which consists of some outstanding investment possibilities in the property market. There is a wide variety of realty investing approaches available to capitalists that don't currently fulfill the SEC's requirements for accreditation.

Ending up being a recognized investor is simply a matter of verifying that you satisfy the SEC's demands. To confirm your income, you can provide documentation like: Revenue tax obligation returns for the past two years, Pay stubs for the past two years, or W2s for the previous two years. To verify your internet well worth, you can offer your account declarations for all your possessions and responsibilities, including: Savings and examining accounts, Investment accounts, Exceptional fundings, And property holdings.

Popular Accredited Investor Real Estate Deals

You can have your attorney or CPA draft a confirmation letter, verifying that they have actually evaluated your financials which you meet the requirements for a recognized investor. However it might be more cost-effective to utilize a solution specifically created to confirm certified capitalist conditions, such as EarlyIQ or .

If you sign up with the genuine estate investment company, Gatsby Financial investment, your certified financier application will certainly be processed with VerifyInvestor.com at no expense to you. The terms angel financiers, sophisticated investors, and accredited investors are commonly used mutually, however there are subtle distinctions. Angel financiers give seed cash for startups and local business in exchange for ownership equity in the business.

Usually, anybody who is accredited is thought to be an innovative capitalist. The income/net worth requirements remain the very same for international investors.

Here are the very best investment opportunities for recognized investors in genuine estate. is when investors merge their funds to acquire or remodel a building, then share in the proceeds. Crowdfunding has come to be one of the most prominent techniques of investing in genuine estate online considering that the JOBS Act of 2012 allowed crowdfunding systems to offer shares of realty projects to the public.

Expert Top Investment Platforms For Accredited Investors

Some crowdfunded property financial investments don't require certification, yet the tasks with the best prospective rewards are normally reserved for recognized capitalists. The difference in between tasks that accept non-accredited financiers and those that only approve recognized financiers generally comes down to the minimal financial investment amount. The SEC currently restricts non-accredited capitalists, who earn less than $107,000 per year) to $2,200 (or 5% of your yearly revenue or internet worth, whichever is much less, if that quantity is more than $2,200) of investment resources per year.

It is extremely similar to genuine estate crowdfunding; the process is basically the same, and it comes with all the very same benefits as crowdfunding. Actual estate syndication uses a steady LLC or Statutory Count on possession version, with all investors serving as participants of the entity that has the underlying genuine estate, and a syndicate that assists in the job.

a company that invests in income-generating property and shares the rental revenue from the residential or commercial properties with investors in the form of rewards. REITs can be publicly traded, in which instance they are controlled and offered to non-accredited capitalists. Or they can be exclusive, in which case you would need to be accredited to spend.

Efficient Private Equity For Accredited Investors

Management fees for a private REIT can be 1-2% of your total equity each year Acquisition fees for new acquisitions can come to 1-2% of the purchase price. And you may have performance-based charges of 20-30% of the personal fund's earnings.

But, while REITs focus on tenant-occupied residential or commercial properties with secure rental earnings, private equity actual estate firms concentrate on realty growth. These companies commonly develop a story of raw land right into an income-generating residential property like an apartment building or retail shopping mall. Just like private REITs, capitalists secretive equity endeavors normally require to be certified.

The SEC's interpretation of certified financiers is made to identify people and entities regarded monetarily sophisticated and with the ability of assessing and joining specific kinds of private financial investments that might not be readily available to the basic public. Significance of Accredited Investor Condition: Conclusion: Finally, being a recognized capitalist brings considerable value worldwide of financing and financial investments.

Five-Star Accredited Investor Wealth-building Opportunities

By meeting the criteria for recognized financier status, people demonstrate their economic refinement and gain access to a world of financial investment possibilities that have the prospective to generate substantial returns and contribute to long-term financial success (accredited investor investment funds). Whether it's spending in startups, actual estate endeavors, exclusive equity funds, or other alternative possessions, accredited financiers have the opportunity of exploring a diverse range of financial investment options and constructing wealth on their very own terms

Accredited capitalists consist of high-net-worth individuals, banks, insurance provider, brokers, and trust funds. Approved investors are defined by the SEC as qualified to buy facility or innovative kinds of safety and securities that are not closely regulated. Particular criteria have to be fulfilled, such as having an ordinary yearly income over $200,000 ($300,000 with a partner or cohabitant) or operating in the financial sector.

Non listed safeties are inherently riskier because they do not have the normal disclosure demands that come with SEC registration. Investopedia/ Katie Kerpel Accredited capitalists have fortunate accessibility to pre-IPO firms, financial backing firms, hedge funds, angel financial investments, and different deals involving complex and higher-risk investments and tools. A firm that is seeking to elevate a round of funding might decide to directly approach recognized investors.

Latest Posts

Esteemed Overages Surplus Funds Program Overages Surplus Funds

Market-Leading Tax Overage Recovery Strategies Course Tax Overages List

How To Buy Tax Lien Property